canalys forecasts: global smartphone shipments will increase by 4% to 1.17 billion units in 2024-尊龙手机版下载

date:2023-11-29

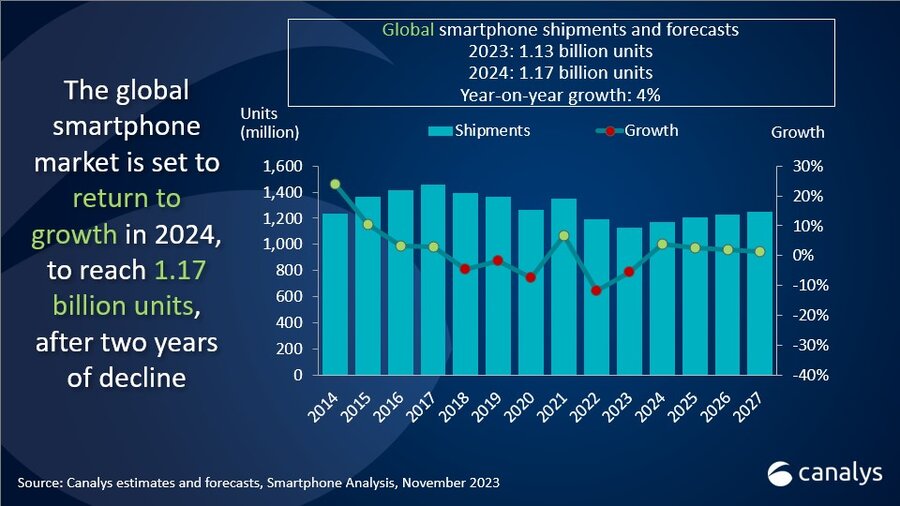

the hints at early signs of recovery after declining 12% in 2022, according to new forecasts from canalys. while shipments are still expected to drop 5% in 2023, the softening decline points at stabilization as regions like the middle east, africa and latin america return to growth at 9%, 3% and 2%, respectively this year. in the full year 2023, 1.13 billion smartphones will be shipped, which is expected to grow 4% to reach 1.17 billion units in 2024. the smartphone market is expected to ship 1.25 billion units in 2027, achieving a cagr (2023 to 2027) of 2.6%.

“the smartphone industry is clearly emerging from its darkest days, even as the shipments remain over 20% below its 2017 peak,” stated toby zhu, senior analyst at canalys. “the good news is that consumers are placing more value on their devices than ever before, with average selling prices now exceeding us$440 versus us$332 in 2017. profitability is looking up for hardware makers strategically launching flashy new features to captivate consumers in key growth markets.”

“the smartphone rebound in 2024 will be fueled by emerging markets, where the devices remain integral to connectivity, entertainment and productivity,” said sanyam chaurasia, senior analyst at canalys. “one in three smartphones shipped in 2024 will be purchased in the asia pacific versus only one in five back in 2017. this region will also witness some of the fastest growth at 6% year-over-year, driven by resurging demand in india, southeast asia and south asia. as macroeconomic conditions and consumer confidence stabilize in these countries, smartphone upgradation will accelerate.”

“on-device ai capabilities will have limited impact in driving high-end smartphone upgrades in 2024,” cautioned runar bjørhovde, analyst at canalys. “we expect less than 5% of smartphones shipped next year to be equipped with advanced ai-capable chipsets that can run on-device ai models. the growth of premium smartphones has plateaued out as replacement demand in developed markets like western europe and the us remains weak. many consumers in these markets already upgraded to high-end devices during the pandemic when discretionary cash was abundant. a real growth cycle in premium devices in these regions likely would not occur until 2024-2025, when ai features and use cases become compelling enough to motivate upgrades.”

“with improving business conditions in 2024, chinese players like honor, transsion and xiaomi are expected to aggressively expand outside greater china rather than playing defense,” added zhu. “despite persisting geopolitical uncertainties, competition is expected to rise, especially in high-growth emerging markets. still, optimism is growing among channels, vendors and the supply chain.”

|

global smartphone shipment forecast and annual growth

|

|||||

|

region |

2022 |

2023 |

2024 |

annual |

annual |

|

asia pacific |

352.6 |

329.8 |

349.6 |

-6% |

6% |

|

europe |

164.5 |

146.2 |

156.1 |

-11% |

7% |

|

greater china |

297.2 |

280.5 |

286.5 |

-6% |

2% |

|

latin america |

116.5 |

119.1 |

123.5 |

2% |

4% |

|

middle east and africa |

113.7 |

119.8 |

127.5 |

5% |

6% |

|

north america |

148.9 |

133.3 |

131.1 |

-11% |

-2% |

|

total |

1193.4 |

1128.7 |

1174.1 |

-5% |

4% |

|

note: percentages may not add up to 100% due to rounding |

|

||||